Unknown Facts About Offshore Banking

Table of ContentsFacts About Offshore Banking UncoveredHow Offshore Banking can Save You Time, Stress, and Money.Offshore Banking Fundamentals ExplainedThe Ultimate Guide To Offshore BankingThe Best Strategy To Use For Offshore Banking

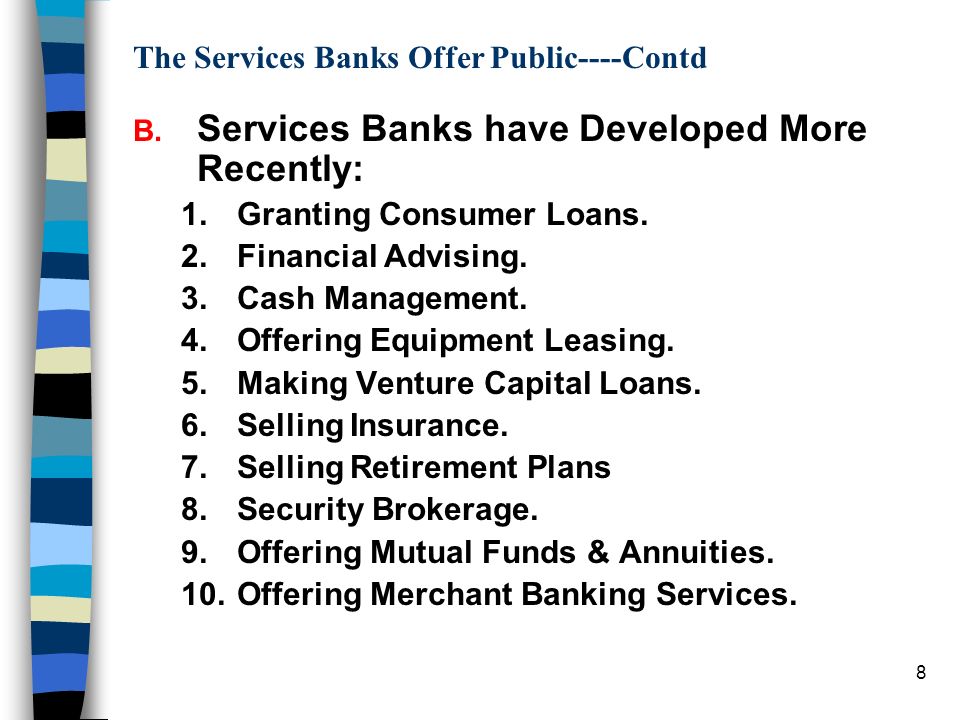

Some common kinds of financings that banks supply include: If your current banks doesn't offer the solutions pointed out over, you might not be obtaining the most effective banking service possible. At First Financial institution, we are committed to assisting our customers get the most out of their money. That is why we provide different kinds of financial solutions to satisfy a selection of requirements.

Pay expenses, lease or top up, acquire transportation tickets as well as even more in 24,000 UK areas

If you get on the hunt for a brand-new monitoring account or you intend to start investing, you could require to set apart time in your routine to do some study. That's because there are lots of kinds of banks and also monetary institutions. By comprehending the different kinds of banks and their features, you'll have a much better feeling of why they are very important and exactly how they contribute in the economic situation.

All about Offshore Banking

In terms of financial institutions, the central bank is the head top dog. Main financial institutions handle the money supply in a solitary nation or a series of nations.

Retail banks can be typical, brick-and-mortar brands that clients can access in-person, online or through their smart phones. Others only make their devices and also accounts readily available online or through mobile applications. There are some kinds of industrial financial institutions that aid day-to-day customers, industrial financial institutions tend to focus on sustaining companies.

The shadow banking system is composed of monetary groups that aren't bound by the same stringent guidelines and also policies that various other financial institutions need to follow. Just like the basic managed financial institutions, darkness financial institutions manage credit history and also different kinds of assets. However they get their financing by borrowing it, connecting with investors or making their very own funds as opposed to utilizing money released by the main financial institution.

Cooperatives can be either retail financial institutions or commercial banks. What identifies them from other entities in the economic system is the truth that they're usually regional or community-based associations whose participants help identify exactly how the service is operated. They're run democratically and also they offer finances and also savings accounts, to name a few points.

Offshore Banking Things To Know Before You Buy

Like banks, credit history unions provide lendings, provide financial savings as well as inspecting accounts over at this website and also fulfill other economic needs for customers and also services. The difference is that banks are for-profit business while credit unions are not - offshore banking.

In the past, S&Ls mainly served as cooperative organizations. Participants took advantage of the S&L's services as well as made even more rate of interest from their savings than they can at business financial institutions. For a while, S&Ls weren't managed by the government, now the federal Office of Thrift Guidance oversees their activity. Not all financial institutions serve the exact same function.

Over time, they have actually been widely used by both advanced book managers and also by those with even more straightforward needs. Sight/notice accounts and also dealt with and drifting price down payments Fixed-term down payments, likewise denominated in a basket of money such as the SDR Versatile quantities as well as maturities An eye-catching financial investment widely used by reserve supervisors searching for additional yield and also outstanding credit scores top quality.

This paper offers a strategy that financial institutions can make use of to assist "unbanked" householdsthose who do not have accounts at deposit institutionsto sign up with the mainstream economic system. The key objective of the method is to assist these households construct savings and also improve their credit-risk accounts in order to lower their cost of payment services, remove a common resource of individual anxiety, and get to lower-cost sources of credit report.

How Offshore Banking can Save You Time, Stress, and Money.

Third, it is much better structured to help the unbanked ended up being typical financial institution clients. 4th, it is additionally most likely to be a lot more rewarding for financial institutions, making them more willing to apply it.

They have no immediate need for credit history or do not discover that their unbanked status excludes them from the credit score that they do require. Repayment solutions are also not problematic for a selection of reasons.

Most financial institutions in city areas won't cash paychecks for individuals that do not have an account at the financial institution or who do not have an account with try these out sufficient funds in the account to cover the check. It can be fairly pricey for somebody living from paycheck to paycheck to open Recommended Reading a checking account, also one with a reduced minimum-balance requirement.

Each bounced check can cost the account owner $40 or even more considering that both the check-writer's financial institution and also the vendor that approved the check commonly penalize charges. It is likewise expensive as well as bothersome for financial institution consumers without checking accounts to make long-distance settlements. Mostly all banks charge at least $1 for money orders, as well as several cost as much as $3.

Offshore Banking Can Be Fun For Everyone

As kept in mind in the introduction, this paper says that the most efficient as well as inexpensive ways to bring the unbanked into the financial system must involve 5 measures. Below is a description of each of those measures and their rationales. The initial step in the proposed approach calls on taking part financial institutions to open specialized branches that offer the full variety of commercial check-cashing services as well as standard consumer financial services.